The Ultimate Guide To Hsmb Advisory Llc

The Ultimate Guide To Hsmb Advisory Llc

Blog Article

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Table of ContentsOur Hsmb Advisory Llc DiariesThe 4-Minute Rule for Hsmb Advisory LlcAll About Hsmb Advisory LlcHsmb Advisory Llc Fundamentals ExplainedThe Basic Principles Of Hsmb Advisory Llc Some Of Hsmb Advisory LlcAll about Hsmb Advisory Llc

Be conscious that some plans can be expensive, and having particular health conditions when you use can enhance the costs you're asked to pay. You will require to see to it that you can pay for the costs as you will need to devote to making these settlements if you desire your life cover to stay in positionIf you feel life insurance might be valuable for you, our collaboration with LifeSearch allows you to obtain a quote from a variety of service providers in double double-quick time. There are different sorts of life insurance coverage that aim to satisfy different protection needs, consisting of level term, lowering term and joint life cover.

What Does Hsmb Advisory Llc Do?

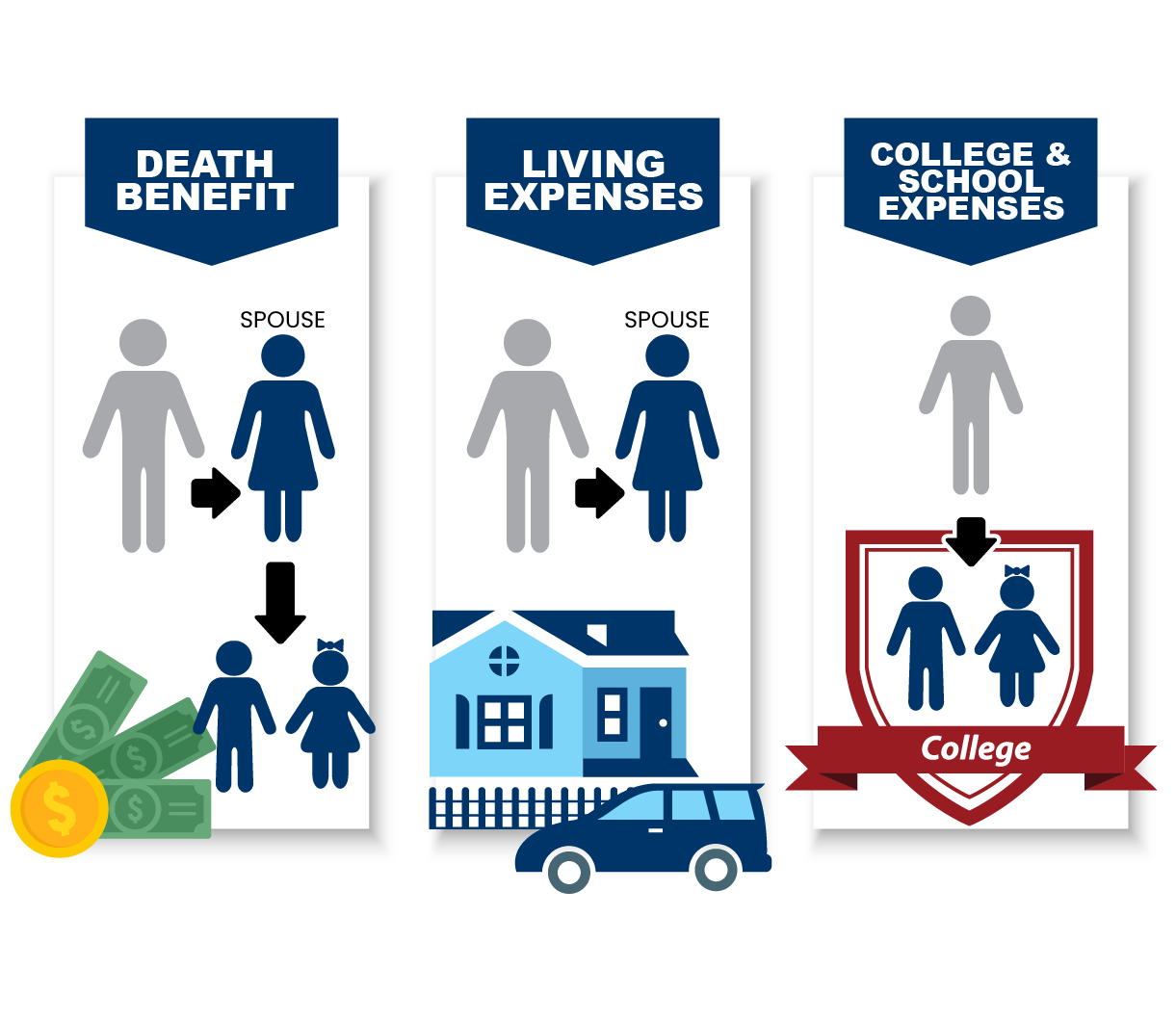

Life insurance policy provides five economic advantages for you and your family members (Insurance Advise). The primary benefit of adding life insurance policy to your monetary strategy is that if you pass away, your heirs get a swelling amount, tax-free payout from the plan. They can use this money to pay your last costs and to replace your income

Some policies pay if you create a chronic/terminal ailment and some give financial savings you can make use of to sustain your retirement. In this post, learn regarding the numerous advantages of life insurance and why it may be a good idea to purchase it. Life insurance policy offers advantages while you're still to life and when you pass away.

Facts About Hsmb Advisory Llc Uncovered

If you have a policy (or plans) of that size, individuals that depend on your earnings will certainly still have cash to cover their continuous living expenditures. Recipients can use policy advantages to cover crucial day-to-day expenditures like lease or mortgage repayments, energy costs, and grocery stores. Average yearly expenditures for households in 2022 were $72,967, according to the Bureau of Labor Statistics.

4 Simple Techniques For Hsmb Advisory Llc

Development is not affected by market problems, permitting the funds to accumulate at a stable price in time. Furthermore, the cash money value of entire life insurance policy grows tax-deferred. This implies there are no revenue tax obligations accumulated on the money worth (or its growth) till it is withdrawn. As the money value accumulates over time, you can utilize top article it to cover expenses, such as buying an auto or making a deposit on a home.

If you determine to borrow versus your money worth, the loan is not subject to revenue tax as long as the policy is not given up. The insurer, however, will certainly charge passion on the lending quantity till you pay it back (https://visual.ly/users/hunterblack33701/portfolio). Insurer have differing rate of interest rates on these fundings

The Greatest Guide To Hsmb Advisory Llc

8 out of 10 Millennials overestimated the expense of life insurance in a 2022 research. In actuality, the average cost is better to $200 a year. If you believe buying life insurance policy may be a smart monetary action for you and your family members, think about talking to a monetary advisor to embrace it into your financial plan.

The 5 primary sorts of life insurance policy are term life, entire life, universal life, variable life, and final expenditure coverage, additionally understood as funeral insurance coverage. Each type has various attributes and benefits. For instance, term is a lot more budget-friendly but has an expiration day. Whole life begins setting you back much more, however can last your whole life if you maintain paying the costs.

All About Hsmb Advisory Llc

Life insurance can likewise cover your mortgage and provide money for your household to maintain paying their bills (https://sitereport.netcraft.com/?url=https://www.hsmbadvisory.com). If you have family members depending on your earnings, you likely need life insurance to support them after you pass away.

For the most component, there are 2 sorts of life insurance coverage intends - either term or long-term strategies or some mix of the 2. Life insurance companies provide various types of term plans and standard life plans along with "interest delicate" products which have actually become more widespread since the 1980's.

Term insurance gives protection for a specific amount of time. This period might be as brief as one year or offer insurance coverage for a details number of years such as 5, 10, 20 years or to a defined age such as 80 or in some cases as much as the oldest age in the life insurance coverage mortality tables.

The Ultimate Guide To Hsmb Advisory Llc

Presently term insurance coverage prices are extremely affordable and amongst the most affordable historically knowledgeable. It should be kept in mind that it is a commonly held idea that term insurance is the least costly pure life insurance policy protection available. One needs to assess the plan terms thoroughly to decide which term life alternatives are ideal to meet your specific conditions.

With each new term the costs is boosted. The right to renew the plan without evidence of insurability is a crucial benefit to you. Or else, the threat you take is that your health and wellness might degrade and you might be unable to obtain a policy at the exact same prices or perhaps in all, leaving you and your beneficiaries without protection.

Report this page